QuickBooks Online vs. QuickBooks Desktop - Which Is Right For You?

For many of us, QuickBooks Desktop was the go-to bookkeeping software for years. Solid, dependable and very functional, it was, and still is, an excellent tool for just about every kind of small business and their bookkeeping needs.

Recently, however, the emergence of the digital cloud and all it has to offer has moved in on the desktop software market, and with that have come several cloud-based bookkeeping programs. QuickBooks Online, or QBO, is the leader of the pack and continues to improve and evolve to meet the needs of its users. QBO had a slow, rocky start but Intuit has refined their product to perform beautifully and with the utmost in convenience, security and efficiency. In short, QBO makes me happy.

Here are some highlights of how QBO and Desktop compare:

Not using QBO and all it’s features yet?? Want to save yourself some time and headaches? Well then, follow me and let’s dive into the details…

QBO can do what desktop does for your basic bookkeeping. Invoicing, tracking sales and managing accounts payable and reports. It’s how QBO does these basic things that make it unique and stand out not to mention the additional things QBO does that desktop cannot.

Which is more convenient? Desktop or QBO?

QBO wins this convenience battle hands down. QB desktop is only accessible via your desktop where the software is installed; whereas QBO is available anywhere there is internet access. QBO can also be installed as an App, on your tablet or smartphone. Which allows business owners on the go access to their accounts to check bank balances and financials, build estimates for customers on-site, and receive payments immediately.

QBO connects to all your bank accounts and credit cards and auto feeds your transactions as they come through your bank daily. This, in turn, eliminates the need for manual entry of your expense transactions. In QuickBooks desktop, all transactions must be manually entered, or for the few banks that will allow a bank feed download, you must pay an additional $10-$15 a month. This process is very clunky and not nearly as user-friendly as QBO.

Tracking Receipts

For those that find keeping track of receipts a challenge, QBO gives us an efficient solution. Snap a picture of your receipt and upload it directly into your account for safe keeping! This photo will be attached to the expenses in your financials and won’t ever get lost in that never-ending pile (or box, room, basement…we don’t judge) of paperwork to sort and file. Taking photos of your receipts is also a great way to capture those pesky receipts that are printed on thermal paper and quickly rub off and fade!

QuickBooks Desktop is a software that is physically loaded into your computer and requires periodic updating to stay current. Which means annual upgrades that can cost hundreds of dollars at a time. QBO, on the other hand, has a small monthly fee that provides you with a continually updated status, so your bookkeeping is always using the most current and up to date software and data. This is also helpful for small businesses that find it easier to make small budgeted monthly payments, rather than dole out hundreds at one time.

Not only is QBO available anywhere you can find an internet connection, but with QBO Plus you can have up to 5 real-time users with your subscription, plus your accountant and/or bookkeeper. This hyper-efficient way to allow your financial team to review your books and make the needed corrections and adjustments themselves is unmatched. Intuit requires a multi-user license to have more than one user on QuickBooks Desktop, and who wants to pay more money for that? Unless your financial team has a remote login to your system, they can’t adjust your account without an Accountant's copy transfer.

QBO also provides constant real-time back up for your account. No more worrying about backing up your desktop files into the cloud or an external hard drive. We’ve all heard the horror stories of people who had hard drive failures that never did get around to backing up their system, and lose everything. Don’t let that be you.

As you can see QBO is the clear winner for convenience.

Your Sole Proprietorship Could Put Your Family At Risk!

Clients of Halon Tax Grow Their Revenue by 18%/yr on Average

Want to hear more about how we help small business owners?

Oops! Something went wrong while submitting the form

Invoicing

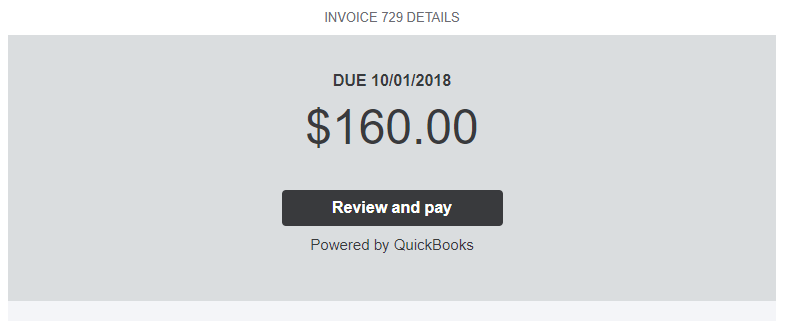

Invoicing is a crucial component of any business…you need to get paid, right? And the easier it is to get paid, the better.. QBO has a fantastically intuitive invoicing system that simplifies your billing process and saves you time. When you email a client from QBO, it shows when it was sent and when your client viewed it. It eliminates the question of lost invoices and excuses for unpaid billings and will tell you immediately if an email bounced.

You can also schedule invoices to send automatically. Billings that are a consistent amount, like rent or other set monthly rates and fees, can be done automatically for you (almost like magic). ...and who doesn’t need a little magic in their life?

QBO invoices also have the option of intuitive sales tax calculations. If you charge sales tax applicable to your client’s location, your invoice will automatically populate the correct rate for you. Boom. Done. No more time-consuming sales tax rate searches and fear of inaccuracies. This feature alone is a game changer for many businesses.

Another excellent attribute of QBO invoicing is the ability to accept payments via ACH or credit card directly from your invoice. Therefore directly syncing with your QBO records. It takes the hassle out of accepting payments and creating deposits by automatically applying payments and recording deposits as they settle.

It's not just in invoicing and convenience that QBO beats the desktop version; you also receive access to a plethora of benefits using QBO.

One of QBO ’s newest features is the Projects option for individual businesses. This new feature gives small business owners the ability to do job costing in real time, and pull reports based on just that job. You can see where you’re at, how much time and money you’ve put into it, how much you’ve collected so far from your customer and you can project your profit margin and make any necessary adjustments.

For QBO Accountant users, you also have access to QBO Work. Work is the best tool a firm owner could ask for to manage their clients, tasks, billing, and provide a secure internal portal for client requests. This option gives Bookkeepers the ability to manage their business primarily in one place. I, for one, love one-stop shopping, so Work is my personal favorite feature.

QBO also gives you access to phone support for no additional fee. With Desktop you have to pay an additional fee for phone support. Why would you pay an additional fee for a product you already paid for?

I actually saved QBO’s biggest advantage over QB desktop for last: QBO can connect to over 300 different apps. If you’re not familiar, apps are add-on programs that you can connect to your QBO account that work together in partnership to provide you with more information, convenience, and time-saving opportunities. You can use an App for time tracking ( like TSheets) and have your employee time cards directly connect to your QBO account. You can also connect apps that help you track mileage, do specific types of industry invoicing, utilize other payment processors, etc. The app list is very extensive and worth exploring.

Cloud-based technologies are the way of the future. Thankfully, Intuit knows this and has brought us a fantastic product with QuickBooks Online. Including all the functionality, the support, and training you might need to be successful in this new platform.

It’s well worth your time to make the switch and easily upload your Desktop files into QBO. Having your full business financials in one place that is not only more secure but efficient and always available to you is a wonderful plus for any business owner.

Once you have your QBO account set up, Halon will be ready and waiting for you to prepare and file your business’ taxes. You’ll be on your way to a brand new wonderful tax experience!